Beyond cross-border boundaries: the place and purpose of national tax schemes in MDR

1. What is MDR and what is its purpose?

Tax scheme reporting (MDR) is an information obligation under the Tax Ordinance Act (Articles 86a–86o), which aims to counter aggressive tax optimisation, increase the transparency of the tax system and enable tax authorities to respond quickly to new forms of tax avoidance.

2. How does MDR work in practice?

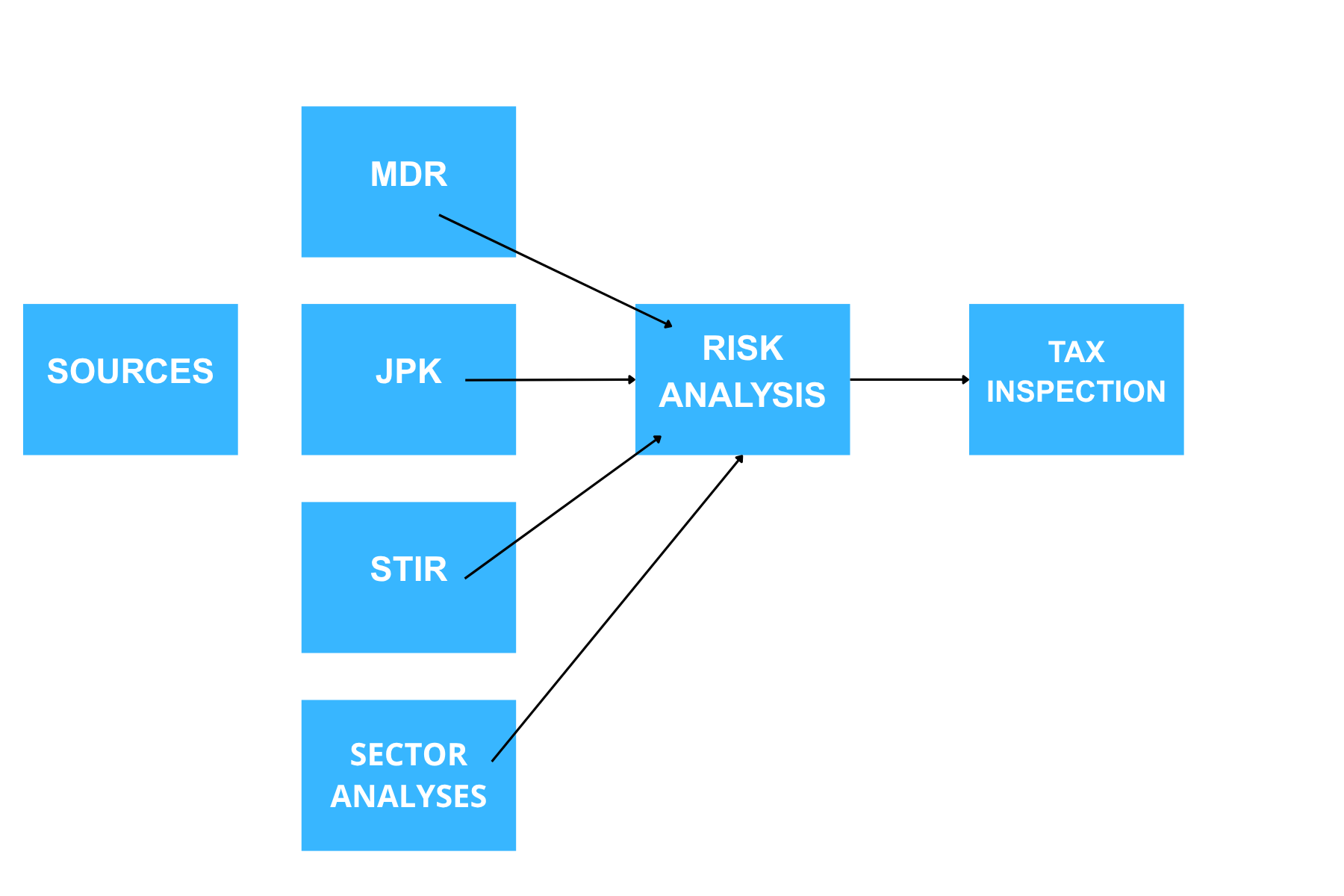

The infographic below shows the place of MDR in the tax supervision system:

Infographic: MDR diagram in the tax supervision system based on publicly available data

Description of the diagram: MDR, JPK, STIR and sectoral analyses are the main sources of data. This data is fed into the KAS risk analysis systems. On this basis, customs and tax audits may be initiated, although MDR mainly has a preventive and analytical function.

3. How to make the MDR system effective and reliable?

The obligation to report tax schemes (MDR) is crucial for combating aggressive tax planning and tightening the tax system. However, in order for it to fulfil its role, it is not enough to simply collect information – this data must be actively and effectively used by the tax administration.

Or is it the case that many MDR reports remain merely a “formal obligation” with no real impact on control activities? Such a situation would undermine confidence in the system among both taxpayers and the institutions responsible for its supervision. Let us assume that the system works, so:

- MDR reports provide a basis for targeting controls precisely at entities actually involved in aggressive planning schemes, thereby increasing the effectiveness of actions and reducing unnecessary burdens on honest businesses

- the use of artificial intelligence and machine learning enables the rapid identification of high-risk schemes, repetitive patterns and links between promoters and users of schemes

- authorities systematically check the accuracy and completeness of MDR reports, eliminating situations of deliberate avoidance of reporting and thus increasing the effectiveness of the entire system

- Regular publication of summary reports on schemes and the effects of their use, and providing taxpayers with up-to-date guidance and substantive support, increases the transparency of the system and confidence in it.

Without these measures, the MDR system would risk remaining a formal obligation that does not fulfil its purpose, and taxpayers would perceive it as an additional burden, seeing no benefits or real impact on improving the transparency of the tax market.

4. MDR amendment in 2025 – what is changing?

1. Statutory definitions:

– Aligning the definitions in the area of MDR with the requirements of the DAC6 Directive is a key element of the changes in Polish legislation aimed at harmonising the rules in this area. Thanks to these changes, information will be correctly exchanged with the EU and entities will be certain that the agreement held by the NSP is a tax scheme.

2. Professional secrecy:

- – Adaptation of provisions to CJEU judgments (C-694/20 and C-623/22) and DAC8

3. White list:

– introduction of the possibility for the minister responsible for public finance to issue a regulation exempting national agreements subject to notification from reporting – the expected “white list”

4. Subject exemptions:

– introduction of the possibility for the minister responsible for public finance to issue a regulation specifying groups of entities that will be exempt from the obligation to report tax schemes relating to national agreements

5. Exemptions from reporting national arrangements subject to notification in relation to which the tax authorities have TPR or IFT information

6. Combination of other specific identifying features with the main benefit test

7. Elimination of one of the entities – the “supporting” entity – required to submit information on tax schemes

5. Protection of notifiers – Article 86h of the Tax Ordinance

Pursuant to Article 86h of the Tax Ordinance: The notification of a tax scheme cannot in itself constitute grounds for initiating criminal tax proceedings. In order to initiate criminal tax proceedings, a customs and tax audit must first be carried out. This means that MDR has a protective function – it encourages voluntary disclosure of arrangements without the risk of criminal sanctions.

The amendment introduces the possibility of punishing acts consisting in the late submission of information referred to in Article 80f § 1 and 2 of the Act of 10 September 1999 – the Fiscal Penal Code, only on the basis of information provided under Section III of Chapter 11a of the Tax Ordinance.

6. Hypothesis: What would happen if the legislator did not introduce reporting of domestic tax schemes?

- Information gap – lack of knowledge on the part of authorities about schemes used exclusively in Poland

- Inequalities – only cross-border arrangements would be reported, which would reward local optimisation structures

- Limited prevention – no warning signals for the National Revenue Administration

- Greater risk of abuse – especially in transactions related to restructuring, mergers, transformations or family foundations.

Reporting domestic tax schemes – other than cross-border ones – is an important instrument for protecting fair competition and a tool for limiting aggressive tax planning in the domestic context.

As indicated in the explanatory memorandum to the act introducing MDR into the Polish legal system, aggressive tax avoidance is not limited to cross-border structures, but also occurs to a significant extent in domestic relations. Domestic schemes are often more difficult to detect, and their prevalence in certain industries leads to a lasting distortion of competition.

Entities using domestic tax schemes to avoid taxation gain an undue competitive advantage at the expense of taxpayers who comply with the rules and do not engage in aggressive optimisation practices. This leads to a violation of the principle of equality before the law and to the deepening of barriers to fair business conduct. Such an advantage, as the legislator rightly points out, cannot be protected by law.

From the point of view of public interest and tax fairness, the reporting of domestic tax schemes is therefore fully justified. Its purpose is not to penalise legitimate optimisation activities, but to give tax authorities earlier access to information about arrangements that may indicate aggressive tax planning, even before they are implemented.

However, the effectiveness of reporting national tax schemes does not stem from the mere existence of the reporting obligation, but from its practical use. If tax authorities do not analyse the information provided, do not carry out targeted control measures or do not verify reporting obligations, this tool loses its operational value and becomes a formality with little impact on the market.

Only the actual use of data on national tax schemes – both by the tax administration and in the legislative process – allows the objectives of reporting national tax schemes to be achieved, i.e.:

- reducing tax abuse,

- tightening the tax system,

- levelling the playing field between taxpayers,

- increasing the effectiveness of tax control through better risk profiling.

Consequently, reporting on domestic tax schemes is not only justified from a systemic and economic point of view, but also remains necessary from the perspective of fair competition and budgetary balance – provided that it is used in accordance with the legislator’s intention, i.e. as an active tool to counter harmful tax practices.

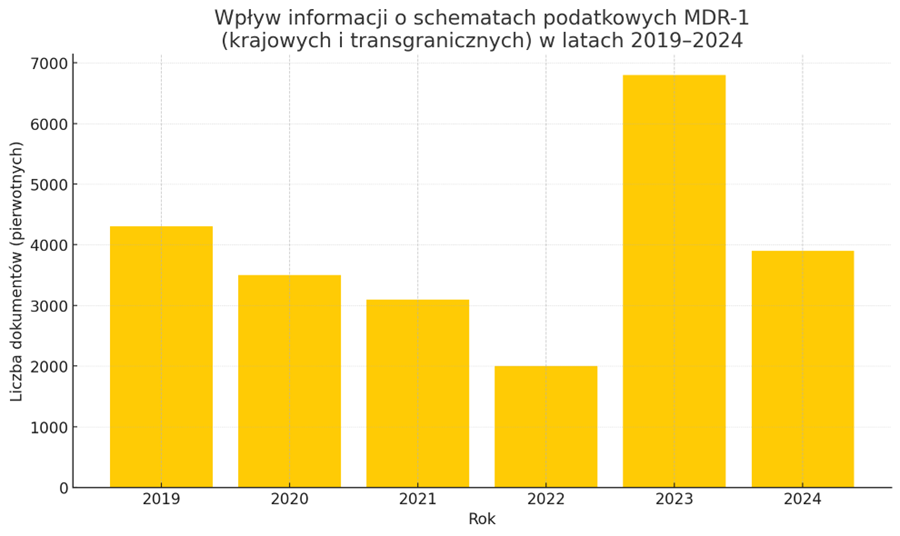

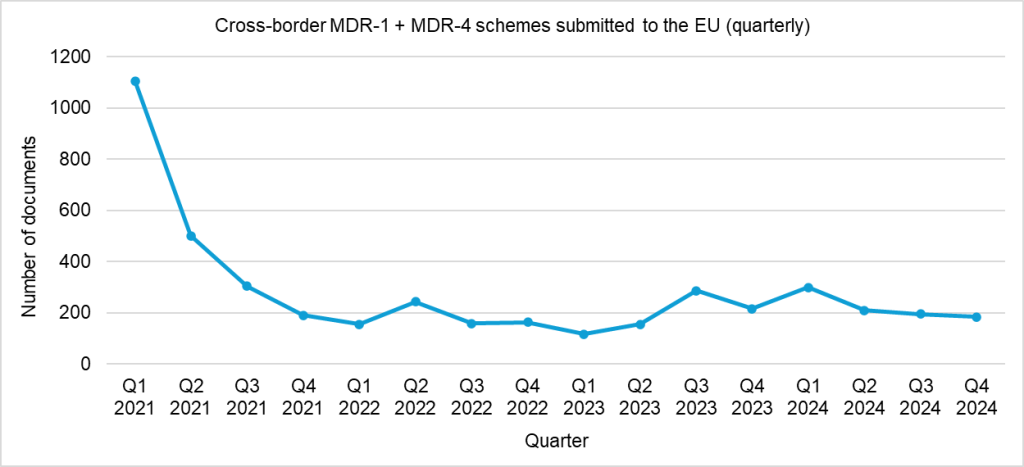

It is worth noting that only about 16% of the reported schemes are cross-border schemes (statistical data taken from the website podatki.gov.pl, Ministry of Finance), which clearly shows that it is domestic tax arrangements that constitute the main area of challenges and require special attention from the administration.

Without these measures, the MDR system risks remaining a formal obligation that does not fulfil its purpose, and taxpayers will perceive it only as an additional burden, seeing no benefits or real impact on improving the transparency of the tax market.wę przejrzystości rynku podatkowego.

7. Psychological mechanisms of tax compliance

Research in tax psychology (Kirchler, Braithwaite, Alm, Frey et al.) shows that three main areas influence taxpayers’ decisions:

A. Trust in tax authorities

– High trust promotes voluntary compliance.

– Minimal action by authorities (e.g. lack of controls, low penalties, fictitious actions) can reduce this trust.

B. Perception of fairness and legitimacy of the law

– If the law (e.g. MDR) is perceived as inconsistent, ineffective or unenforceable, it loses its “symbolic power” – and taxpayers feel less obliged to comply with it.

C. Risk calculation (classical model) vs. social norms (psychological model)

– When the risk of detection is low and penalties are symbolic, the temptation to act in violation of the law increases.

– People are also guided by social norms: if they see others ignoring MDR, they may follow suit (the “everyone else is doing it” effect).

2. Conclusions: impact of weak response by authorities on MDR compliance

If the authorities’ response to non-reporting of MDR schemes is:

– Negligible (no audits, analyses, penalties)

– Provisional (superficial, ineffective measures)

then

- The motivation for voluntary reporting decreases because there is no real moral or legal incentive.

- Tolerance for avoiding reporting increases, especially among professional entities (e.g. advisors).

- Opportunistic attitudes are spreading – taxpayers are beginning to perceive MDR as a dead letter that need not be feared.

- The preventive effect of MDR disappears – its main strength was supposed to be the self-awareness of entities, not mass inspections.

- A legitimacy gap is emerging – compliance with MDR is no longer a “civic duty” but a game of risk.

From the perspective of tax regulation psychology, the introduction of mandatory tax scheme reporting without any visible reaction from the administration leads to a dislearning effect. When taxpayers and advisors do not see that the data they provide is used in a substantive manner, a phenomenon known as regulatory demotivation arises – compliance with the law begins to be perceived as an unnecessary formal burden rather than a real value.

What is more, many schemes are repetitive in nature, so market participants often follow the same patterns – which, on the one hand, makes them easier to identify, but on the other hand requires a systematic approach to analysis and response. The lack of response from the administration to these repetitive patterns means that they become entrenched as “acceptable risk”, even though they are formally reported as potentially aggressive.

It is therefore crucial that the MDR system is not based solely on the assumption that “the obligation is sufficient”. From a behavioural theory perspective, feedback, visible consequences or rewards for correct behaviour are important. Only then is it possible to consolidate lawful patterns and eliminate those that are contrary to the objective of the regulation.

8. Assessments by tax advisors and experts

1. Overburdening with reporting obligations

Experts point out that Polish MDR regulations go beyond the minimum requirements of the DAC6 Directive, covering, among other things, domestic schemes and VAT transactions. This leads to the need to report many standard business operations, which may be considered an excessive administrative burden.

2. Problems with interpreting the rules

Difficulties have been reported in clearly determining which transactions qualify as tax schemes. Vague definitions and broad criteria, such as “main tax benefit”, may lead to excessive reporting of ordinary business activities.

3. Concerns about sanctions

Although the regulations provide for high penalties for non-reporting (up to 720 daily rates), in practice, there have been no reports of numerous inspections or sanctions imposed. However, the mere threat of high penalties may affect businesses, causing uncertainty and concerns about compliance.

| Aspect | Assessment |

| Scope of obligations | The Polish MDR system covers a broader scope than required by DAC6, which may lead to excessive reporting of standard business operations. |

| Interpretation of regulations | There are difficulties in clearly determining which transactions qualify as tax schemes, which may lead to excessive reporting. |

| Sanctions | Despite the high penalties for failure to report, in practice there have been no reports of numerous inspections or sanctions imposed, although the mere threat of penalties may have an impact on businesses. |

| Professional secrecy | Changes in the scope of professional secrecy for tax advisors have affected reporting practices, shifting responsibility mainly to taxpayers. |

| Recommendations | There is a need to simplify the regulations, clarify the criteria and provide appropriate support tools for businesses in relation to MDR. |

9. Summary: National MDR – a systemic necessity or excessive formalism?

In addition, it is worth noting that legislative work is currently underway to amend the MDR regulations in order to simplify the system and adapt it to the real needs of the market. The draft provides, among other things, for a narrowing of the reporting obligation for domestic schemes, a clarification of definitions and premises (e.g. the concept of “main benefit test”), as well as a reduction of the burden on taxpayers and advisors by eliminating information obligations that are already available to the authorities or that pose a low risk of tax avoidance.

If the amendment is implemented as announced, it may restore the balance between the effectiveness of the system and its social acceptability. However, success will depend not only on changing the rules, but also on their effective enforcement and communication, which will strengthen trust and legitimacy of the entire MDR system.

Do you have additional questions about MDR? Contact our experts!